We like to teach each of our clients the basics of budgeting. It is the foundation of any great financial framework and you simply cannot build a solid home unless you have laid a trusty foundation beneath it.

We tell our clients that the first step to progress is the budget. To have a solid budget and get in the habit of making one either on their own or with their spouse is month is key. For couples, it’s part of the financial communication process. It even edges in on the goal setting realm as well. The budget is the round table where two people can dream and be wild about it too. We encourage folks to think big. If you only think 10-12 months out we get there too quickly and then are left thinking of new goals. Instead we encourage couples to think in decades, retirement years, and other grand goals.

With these huge grandiose goals we can then start to reverse engineer them into smaller bite size tasks and milestones. We like to ask;

“what can you do today, this week, month, quarter, and year to achieve your big dreams.”

We don’t reach our goals and happiness by wandering so we help our people set up plans, goals, and tasks that are intentional to their end game. Begin with the end in mind was something we operate by here and it rings true in a many facets of life.

Single Folks

For our single folks out there it’s often more difficult because you don’t have an accountability partner looking over your shoulder asking you the big questions.

“Is that decision today getting you closer to you goal tomorrow”

Single folks benefit from coaching just as much, if not more, than couples do because it allows them to have someone in their corner, who wants them to win, and who has their interest in their mind all the time. We don’t derive any satisfaction from watching our clients flounder in any way. If you mean business like we do then we want action.

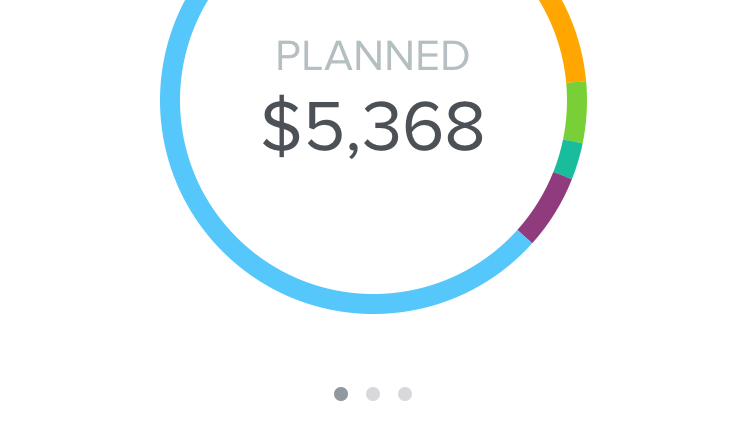

Budgeting for single people is different, but it’s not foreign. We may allocate money differently, but at the end of the day we still want our assets to equal our liabilities. Getting on a budget is a liberating experience for someone who has never done it before. They finally are in tune with how much they are bringing home each month, how much is going out the door, and what that means to their overall picture of financial health.

Bottom Line

We have several different methods to make budgeting easy for you and your family. There are ways that everyone can pitch in and there are ways to make the budget relevant to everyone. It takes a concerted effort from everyone involved, but once you get rolling on a budget this step is one of the easiest and most normal part of being fiscally responsible.

Mature, goal oriented people have a budget and you are no different. We know everyone has dreams, goals, and aspirations for bigger things in life and the budget is where it starts. Laying good ground work ensures the building won’t topple when you put the roof on the structure.